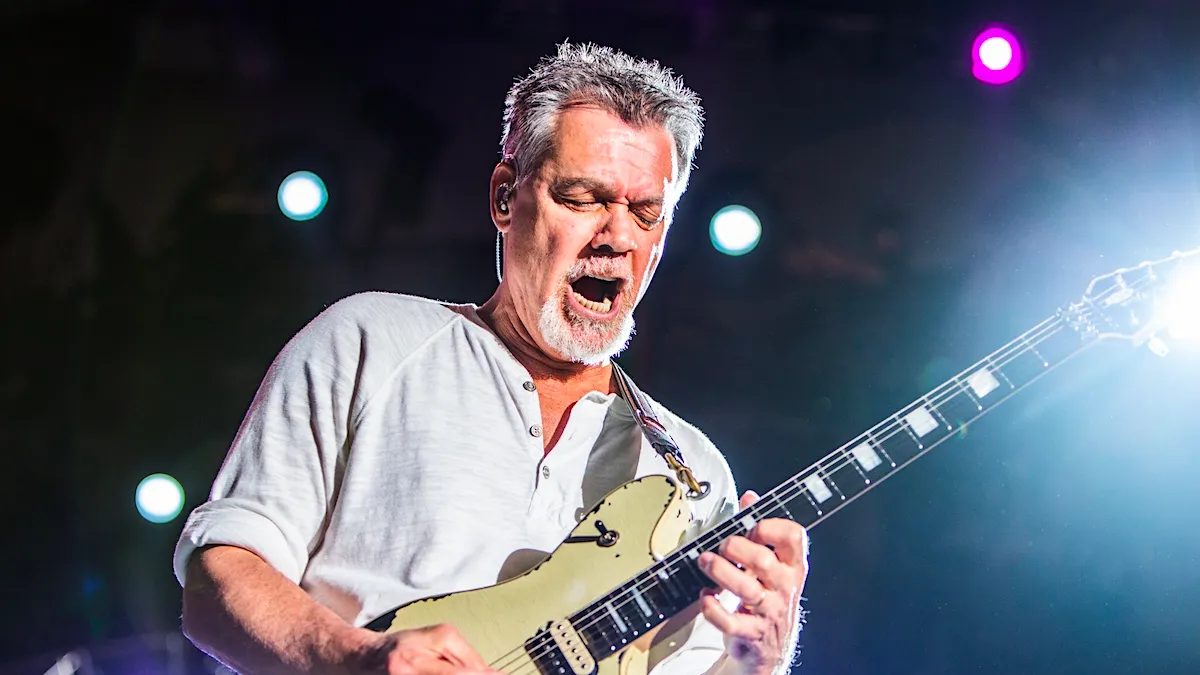

Lessons from Eddie Van Halen’s Estate Planning

Rock and roll legend Eddie Van Halen passed away from cancer at the age of 65, leaving behind a legacy of musical genius and a family to manage his affairs. While details about Van Halen’s estate plan remain private, his situation provides valuable lessons about the importance of living trusts, especially for individuals with complex family dynamics involving multiple marriages and children.

Understanding Living Trusts

A living trust is a legal document that places your assets into a trust during your lifetime and allows for their distribution after your death without the need for probate. This can provide several advantages, including privacy, flexibility, and potential tax benefits. For celebrities like Eddie Van Halen, a living trust can help manage significant assets discreetly.

Multiple Marriages and Estate Planning

Eddie Van Halen was married twice, first to actress Valerie Bertinelli, with whom he had a son, Wolfgang. After their divorce, he remarried Janie Liszewski. Multiple marriages introduce unique challenges in estate planning:

- Alimony and Divorce Settlements: Estate planning must account for any alimony or spousal support arrangements made during a divorce. These financial obligations can significantly impact how assets are distributed.

- Property Ownership: The terms of divorce settlements regarding property ownership need careful consideration. Any property or assets assigned during divorce proceedings must be accurately reflected in the estate plan.

- Children from Previous Marriages: Ensuring that children from a previous marriage are provided for is crucial. This becomes more complex when additional children are brought into the family during a second marriage.

Lessons from Van Halen’s Estate Planning

Although the specifics of Eddie Van Halen’s estate plan are not public, we can glean important lessons for individuals in similar situations:

- Prioritize Privacy: A living trust can help keep estate details private, avoiding public scrutiny and protecting the family’s privacy.

- Plan for Blended Families: Address the needs and rights of children from all marriages to prevent potential disputes. Clear instructions in the living trust can ensure fair distribution.

- Update Regularly: Life events such as divorce, remarriage, and the birth of additional children necessitate regular updates to your estate plan. Keeping it current ensures that it reflects your current wishes and family situation.

- Consider Professional Guidance: Complex family dynamics and substantial assets often require professional estate planning advice

The Importance of a Living Trust

Creating a living trust is a proactive step to safeguard your assets and ensure they are distributed according to your wishes. For individuals like Eddie Van Halen, who have experienced divorce and remarriage, it is especially crucial to address the unique challenges these situations present.

At We The People, we recognize the importance of safeguarding your financial future. Our team of seasoned professionals will guide you through the process of establishing a living trust. We ensure you distribute your assets according to your wishes. From crafting tailored legal frameworks to meticulous management, we prioritize asset protection at every step.

Are you ready to take proactive steps in securing your legacy? Connect with us today at 760-754-9059 to explore our comprehensive services. Schedule a consultation with our experts online here and let us assist you in safeguarding your assets for the future you envision.

0 Comments