John Denver’s Untimely Death

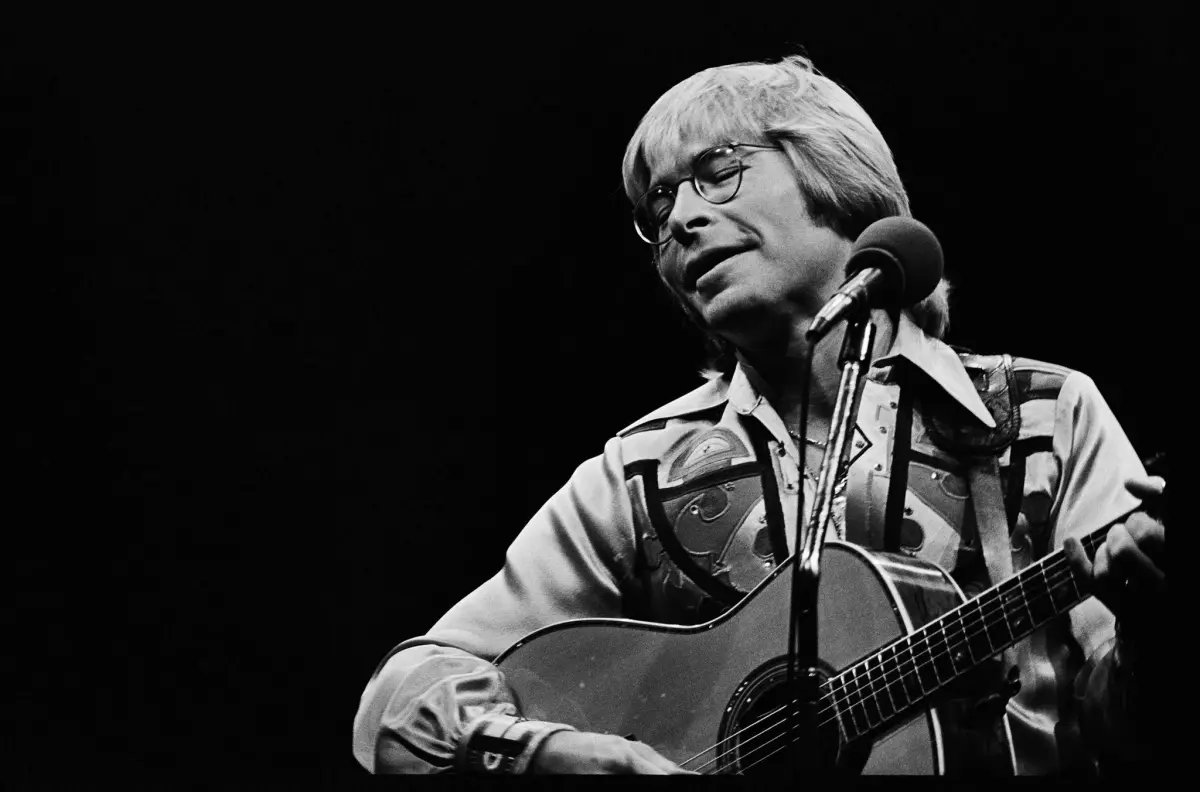

May 15, 1978: John Denver during a performance at the Forum in Inglewood. (Tony Barnard / Los Angeles Times Archive / UCLA)

Dying Without a Will: The Complications of Intestate Laws

John Denver’s death without a Will subjected his estate to California’s intestate laws. These laws determine how assets are distributed when someone dies without clear instructions. Since Denver was unmarried at the time of his death, his estate was split between his children. However, California law treats assets differently depending on whether they were acquired during a marriage.

For example, songs created during a marriage are considered community property. If Denver had been married, his spouse would have inherited the copyrights to his songs. Denver’s lack of a Will also meant that his charitable causes weren’t considered in the estate’s distribution.

As an environmentalist and philanthropist, Denver supported organizations like the National Space Institute, the Cousteau Society, and the Wildlife Conservation Society. Without specific provisions in his Will, these causes didn’t benefit from his estate, despite his previous support.

Trusts vs. Wills: What Could Have Saved Time and Money for Denver’s Family?

While Denver had set up $7 million in trusts for his parents, ex-wife Annie, and children, these trusts were not without complications. He didn’t create a trust for his second ex-wife, Cassandra, adding stress and complexity to the estate’s administration.

Trusts are a powerful estate planning tool. They help protect assets and reduce the time it takes to distribute them. However, they can be more complicated and expensive than drafting a Will. Denver’s situation emphasizes the importance of combining trusts with a Will in a comprehensive estate plan.

Had Denver created a Will to complement his trusts, it could have streamlined the probate process and avoided some legal disputes. His estate could have been settled faster, potentially avoiding the IRS issues that delayed distribution.

The Lengthy Probate Process: How Dying Without a Will Extended Legal Battles

Without a Will, Denver’s estate went through a lengthy probate process. The California probate court took six years to finalize his estate. During this time, his family faced several legal challenges, including disputes with the IRS over the estate’s value. The IRS initially claimed the estate was worth $2.5 million more than stated and demanded $1.5 million in back taxes.

The IRS also disputed the value of Denver’s record label and management company, claiming they were worth more than the estate’s estimate. After years of negotiations, the estate received a $600,000 tax refund, as the IRS had overestimated the assets’ value. Had Denver left a well-drafted Will, many of these complications could have been avoided.

Lessons From John Denver’s Estate: Why You Need a Will

John Denver’s case reminds us of the importance of estate planning. Despite his charitable work and environmental activism, his failure to create a Will caused unnecessary difficulties for his family and the causes he supported. Whether you have a large estate or simply want to ensure your wishes are followed, a Will is essential for securing your legacy.

A Will lets you specify how your assets should be distributed and who will manage your estate. Without one, state laws will decide how your assets are divided—often in ways that don’t reflect your wishes. In addition to a Will, consider creating trusts for your loved ones to avoid delays and costs associated with probate. Trusts offer flexibility in how your assets are distributed, particularly for minor children or individuals with special needs.

At We The People, we recognize the importance of safeguarding your financial future. Our team of seasoned professionals will guide you through the process of establishing a living trust. We ensure you distribute your assets according to your wishes. From crafting tailored legal frameworks to meticulous management, we prioritize asset protection at every step.

Are you ready to take proactive steps in securing your legacy? Connect with us today at 760-754-9059 to explore our comprehensive services. Schedule a consultation with our experts online here and let us assist you in safeguarding your assets for the future you envision.

0 Comments