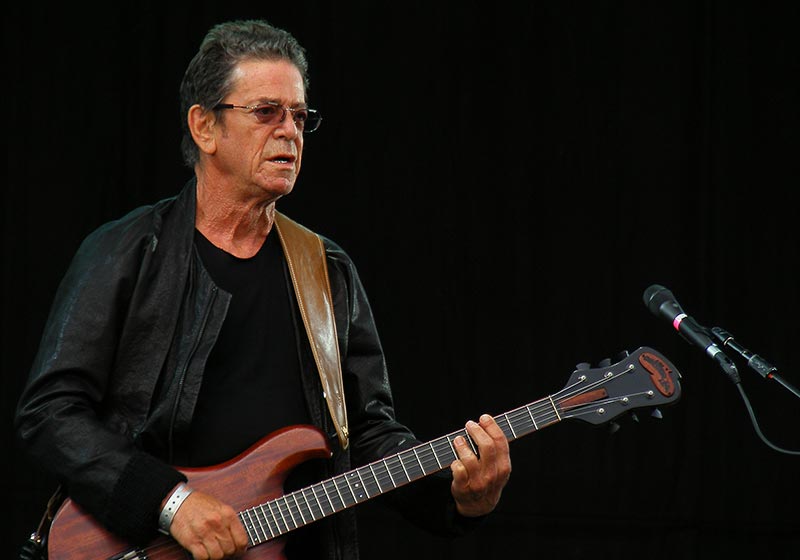

Lou Reed’s Estate: Why Asset Protection and Living Trusts Matter

Lou Reed, the iconic lead singer of The Velvet Underground, passed away on October 27, 2013, leaving behind an estate worth over $30 million. Reed’s influence on music spanned decades. However, his estate plan had crucial gaps, relying on a will instead of a living trust. This decision opened the door to public scrutiny and probate court, revealing intimate details of his wealth and the distribution of assets.

Relying on a Will: The Pitfalls of Lou Reed’s Estate Plan

Reed’s will, signed in 2012, was a detailed 34-page document. However, it lacked a key component—a revocable living trust. As a result, his estate entered probate court, a public process that exposed private details. This included the division of his assets between his wife and sister, as well as the executor’s fees.

Probate is not only public but also time-consuming and costly. While Reed’s family did not face disputes, many families experience legal battles and drawn-out proceedings. This stress and expense could have been avoided with proper planning.

The Benefits of Using a Living Trust to Avoid Probate

Had Reed used a revocable living trust, his estate could have remained private. Unlike a will, a living trust allows assets to bypass probate. This keeps the estate out of the public eye and ensures a smoother transition of wealth to heirs. A trust can protect your assets from being tied up in court, allowing loved ones to manage the estate without added burdens.

For anyone, whether a celebrity or not, a revocable living trust offers key benefits:

- Avoids Probate Court: A living trust bypasses probate, ensuring a faster, private transition of assets.

- Maintains Full Control: It lets you manage your assets while alive and transfers control if you’re incapacitated.

- Reduces Family Conflict: A trust clearly outlines your wishes, reducing the chance of disputes.

- Ensures Incapacity Planning: It includes provisions for managing assets if you’re incapacitated, avoiding court intervention.

Key Estate Planning Lessons from Lou Reed’s Mistakes

Although Reed’s estate was large, the lessons apply to everyone. Probate isn’t just a concern for the wealthy. Relying solely on a will can lead to expenses, delays, and potential family conflicts. Creating a living trust ensures your estate is handled according to your wishes—quickly, privately, and without stress.

At We The People, we recognize the importance of safeguarding your financial future. Our team of seasoned professionals will guide you through the process of establishing a living trust. We ensure you distribute your assets according to your wishes. From crafting tailored legal frameworks to meticulous management, we prioritize asset protection at every step.

Are you ready to take proactive steps in securing your legacy? Connect with us today at 760-754-9059 to explore our comprehensive services. Schedule a consultation with our experts online here and let us assist you in safeguarding your assets for the future you envision.

0 Comments