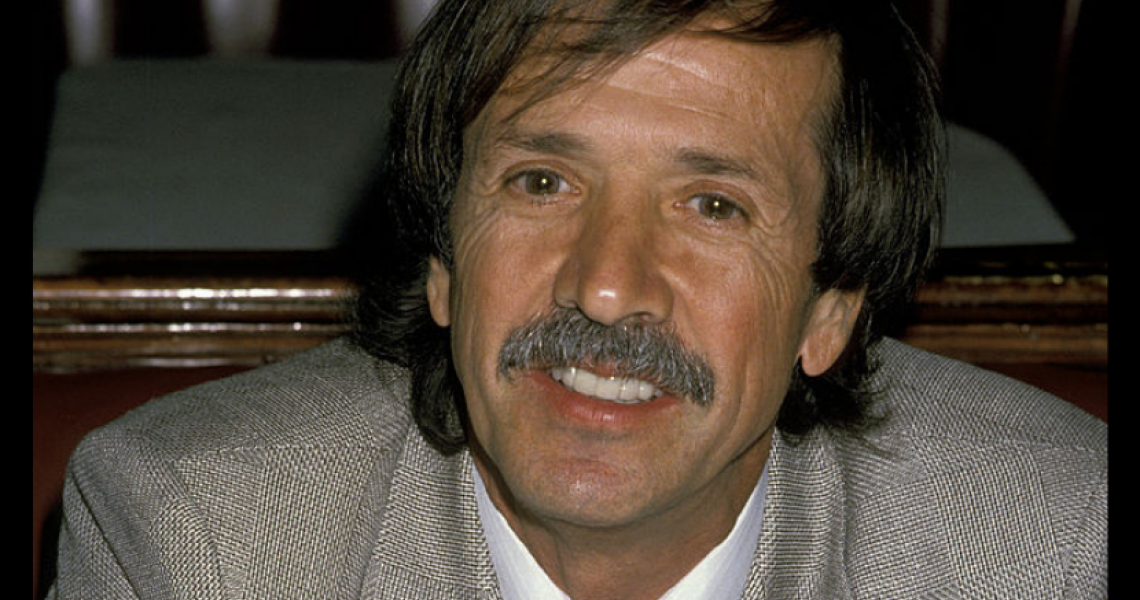

Sonny Bono’s Estate: How a Living Trust Can Prevent Legal Battles

Sonny Bono, the singer, songwriter, restaurateur, and former Congressman, left behind more than just a legacy in music and politics. When he tragically died in a ski accident in 1998 at 62, he left his estate, valued at nearly $2 million, without a Living Trust or any estate planning documents. Despite his intent to create a will, his lack of planning led to years of legal battles for his wife, former Representative Mary Bono. This situation clearly highlights How a Living Trust Can Prevent Legal Battles

.

The Legal Battles Over Sonny Bono’s Estate

After Sonny died unexpectedly, Mary Bono faced a complicated legal fight to become the executor of his estate. With no will or living trust to guide the process, multiple lawsuits emerged. Two notable claims captured public attention:

- Cher’s Claim for Unpaid Alimony: Sonny’s second wife, Cher, sued for $1.6 million in unpaid alimony from their 1974 divorce. Even though Cher has significant wealth, her claim illustrates how financial entanglements can persist long after a divorce, especially without a clear estate plan.

- A Secret Love Child’s Claim: A man named Sean Machu claimed to be Sonny’s illegitimate son. He referenced Sonny’s autobiography, The Beat Goes On, where Bono mentioned an affair with Machu’s mother. Machu later dropped his claim after the court required a DNA test.

Eventually, Mary Bono, along with Sonny’s two children, Chaz Bono and Christy Bono Fasce, divided the estate. However, the process took years of court battles, legal fees, and public scrutiny — all of which a proper estate plan could have avoided.

Why a Living Trust is Essential

Sonny Bono’s estate issues demonstrate why a will alone is not always enough. A Living Trust provides a crucial tool to protect assets, care for loved ones, and ensure that wishes are honored after death. Here’s why a Living Trust offers clear advantages:

- Avoids Probate: A Living Trust bypasses the lengthy and costly probate process. Unlike a will, it allows for faster and private distribution of assets.

- Provides Privacy: Probate court proceedings are public, which means anyone can access your estate’s details. A Living Trust keeps these details private, protecting your family from unwanted scrutiny and potential claims.

- Reduces Legal Challenges: A well-drafted Living Trust is less likely to face court challenges. It clearly states your wishes, reducing ambiguity and the risk of disputes like those involving Cher and the alleged love child.

- Ensures Control Over Asset Distribution: A Living Trust lets you determine how and when to distribute your assets, whether for a child’s education or to support a spouse. It leaves no room for confusion.

- Protects Your Family from Financial Hardship: Without a will or trust, your loved ones could face high legal fees, court costs, and delays that reduce the estate’s value. A Living Trust helps ensure more assets reach your beneficiaries.

Protect Your Legacy Today

Sonny Bono’s estate planning mistakes serve as a clear warning about the risks of neglecting a solid estate plan. While many avoid thinking about what happens after death, failure to plan can create significant challenges for your family, just like it did for Mary Bono.

At We The People, we recognize the importance of safeguarding your financial future. Our team of seasoned professionals will guide you through the process of establishing a living trust. We ensure you distribute your assets according to your wishes. From crafting tailored legal frameworks to meticulous management, we prioritize asset protection at every step.

Are you ready to take proactive steps in securing your legacy? Connect with us today at 760-754-9059 to explore our comprehensive services. Schedule a consultation with our experts online here and let us assist you in safeguarding your assets for the future you envision.

0 Comments