Most people think a living trust is something only the rich or elderly need. After all, if you’re young, healthy, or just have “a few assets,” it doesn’t seem necessary. Right? Wrong.

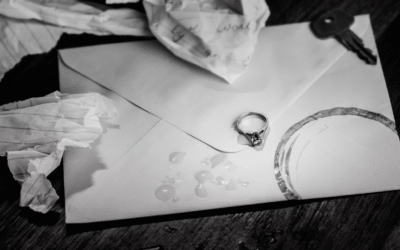

Here’s the truth: by the time you realize you need a living trust, it’s often too late. If an accident happens, or if a sudden illness strikes, your family could be left dealing with frozen accounts, court delays, and confusion about your wishes. That’s why having a living trust is important—it protects your assets, your loved ones, and your peace of mind before something goes wrong.

What Is a Living Trust and Why Does It Matter?

A living trust is a legal document that lets you transfer your assets into a trust while you’re alive, so they can be managed or distributed if you become incapacitated or pass away. You stay in control of everything, and the person you choose (your successor trustee) steps in only when needed—no court required.

Unlike a will, a living trust:

- Avoids probate entirely (saving your family time and money),

- Keeps your affairs private (no public court filings), and

- Lets you plan for incapacity, not just death.

That’s why having a living trust is important for everyone—not just the wealthy.

Real Benefits You Can’t Afford to Ignore

Still wondering if a living trust is worth it? Here’s what it can do:

- Protects minor children and dependents by outlining who gets what and when.

- Prevents family disputes by making your wishes crystal clear.

- Speeds up inheritance—no waiting months for a court to act.

- Gives you peace of mind that your affairs are handled exactly how you want.

If you own a home, have a bank account, or care about avoiding legal messes for your family, a living trust isn’t optional—it’s essential. That’s why having a living trust is important at any stage of life.

Don’t Wait for a Wake-Up Call

Here’s the bottom line: no one thinks they’ll need a living trust—until they do. And by then, the opportunity to make smart, private, and cost-saving decisions may already be gone.

Creating a living trust is faster and more affordable than many people think. With the help of a trusted legal document professional, you can protect your assets and your loved ones with just a few smart decisions today.

You don’t need a living trust… until you do. But by then, it may be too late.

At We The People, we recognize the importance of safeguarding your financial future. Our team of seasoned professionals will guide you through the process of establishing a living trust. We ensure you distribute your assets according to your wishes. From crafting tailored legal frameworks to meticulous management, we prioritize asset protection at every step.

Are you ready to take proactive steps in securing your legacy? Connect with us today at 760-754-9059 to explore our comprehensive services. Schedule a consultation with our experts online here and let us assist you in safeguarding your assets for the future you envision.

0 Comments