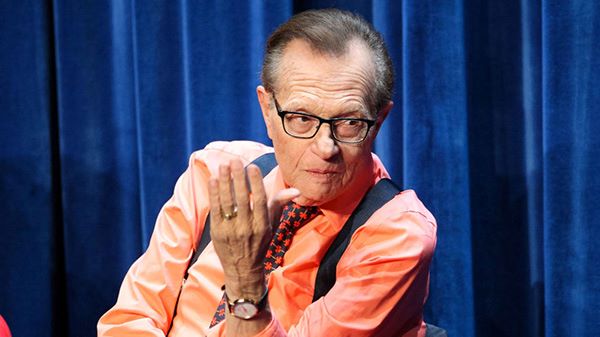

Estate planning might not be the most thrilling topic. However, recent events surrounding Larry King’s estate battle reveal why the importance of living trusts is crucial. The legendary broadcaster’s passing has ignited a legal battle involving his widow, Shawn King, and his son, Larry King Jr. This situation highlights the significance of a well-crafted living trust. Here’s what we can learn from this dispute and why every individual should consider establishing a living trust.

The Larry King Estate Drama

Larry King, the iconic television host, passed away in January 2021. After his death, a contentious legal fight erupted over his estate. Central to the dispute is a handwritten amendment to King’s will, purportedly leaving his assets to his five children. However, Shawn King, his widow, challenged this amendment, arguing that it was made under questionable circumstances. Furthermore, the conflict expanded to include a lawsuit against King’s former business managers, Blouin & Company. She accused them of conspiring with Larry King Jr. to undermine her role as executor of the estate.

What is a Living Trust?

A living trust is a legal document that places your assets into a trust during your lifetime. It then transfers them to your designated beneficiaries upon your death. Unlike a will, a living trust can help avoid probate, ensure privacy, and provide a seamless transition of asset management in case of incapacity.

Why a Living Trust is Essential

- Avoiding Probate: One significant advantage of a living trust is avoiding the probate process. Probate can be lengthy, costly, and public. Consequently, Larry King’s estate has become a public spectacle, highlighting the complications that can arise when probate is involved.

- Ensuring Privacy: Probate court proceedings are public records. Therefore, anyone can access the details of your estate. A living trust keeps your affairs private, shielding your beneficiaries and the distribution of your assets from public scrutiny.

- Preventing Family Disputes: A well-drafted living trust can help prevent family disputes by clearly outlining your wishes. The legal battle between Shawn King and Larry King Jr. underscores the potential for conflict when estate plans are ambiguous or perceived as unfair.

- Incapacity Planning: A living trust includes provisions for managing your assets if you become incapacitated. This ensures your finances are handled according to your wishes without the need for a court-appointed guardian.

- Flexibility and Control: Unlike a will, a living trust can be amended or revoked during your lifetime. Thus, this offers flexibility to adapt to changing circumstances or relationships.

The Case for Professional Guidance

The complications in the Larry King estate battle also emphasize the importance of professional guidance in estate planning. For example, Shawn King’s lawsuit against Blouin & Company, which alleges breaches of fiduciary duty and mishandling of funds, serves as a cautionary tale. Therefore, working with reputable and experienced estate planning professionals can help ensure proper management of your living trust and respect for your wishes.

Conclusion

The legal drama surrounding Larry King’s estate is a powerful reminder of the importance of thorough and thoughtful estate planning. A living trust offers numerous benefits, from avoiding probate to ensuring privacy and preventing family disputes. By taking proactive steps to establish a living trust, you can provide peace of mind for yourself and your loved ones, ensuring your legacy is protected and your wishes are honored.

At We The People, we recognize the importance of safeguarding your financial future. Our team of seasoned professionals will guide you through the process of establishing a living trust. We ensure you distribute your assets according to your wishes. From crafting tailored legal frameworks to meticulous management, we prioritize asset protection at every step.

Are you ready to take proactive steps in securing your legacy? Connect with us today at 760-754-9059 to explore our comprehensive services. Schedule a consultation with our experts online here and let us assist you in safeguarding your assets for the future you envision.

0 Comments